Enhance Your Investments With High-Flying Airline Bond Ratings: Click Now For Exclusive Insights!

Airline Bond Ratings: Assessing the Financial Stability of Airlines

Welcome, readers, to this informative article about airline bond ratings. In today’s globalized world, airline companies play a crucial role in connecting people and facilitating international trade. However, the airline industry is not without its risks and uncertainties. That’s where airline bond ratings come into the picture. These ratings provide valuable insights into the financial stability and creditworthiness of airlines, allowing investors and stakeholders to make informed decisions. In this article, we will explore the intricacies of airline bond ratings, their significance, and their impact on the aviation industry.

Introduction

1. What are Airline Bond Ratings?

3 Picture Gallery: Enhance Your Investments With High-Flying Airline Bond Ratings: Click Now For Exclusive Insights!

2. Who Assigns Airline Bond Ratings?

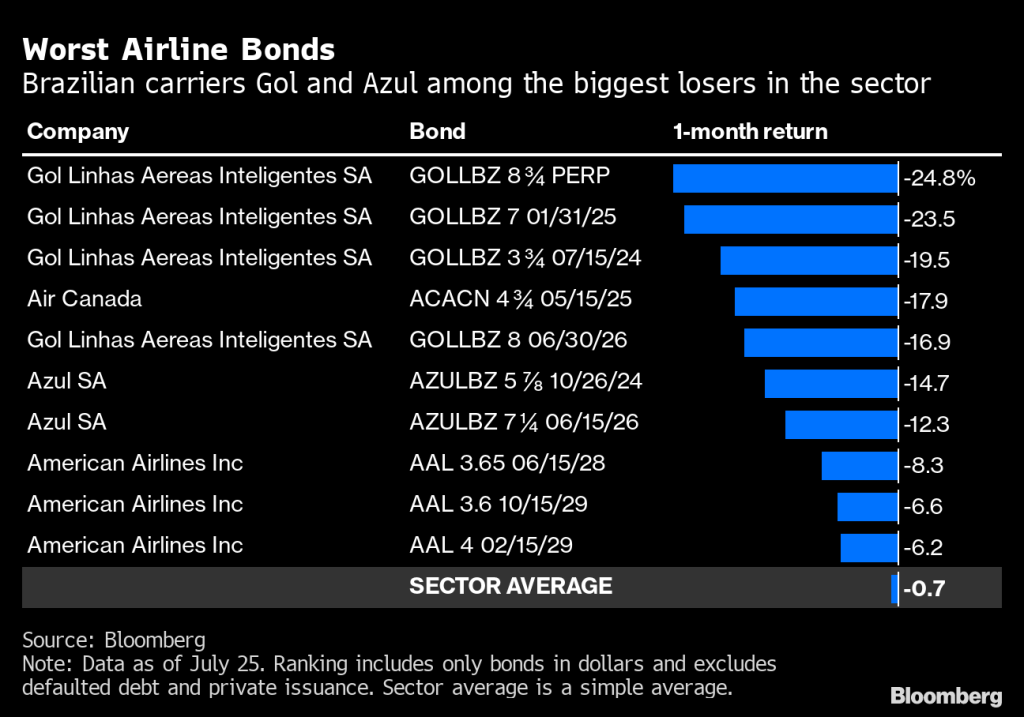

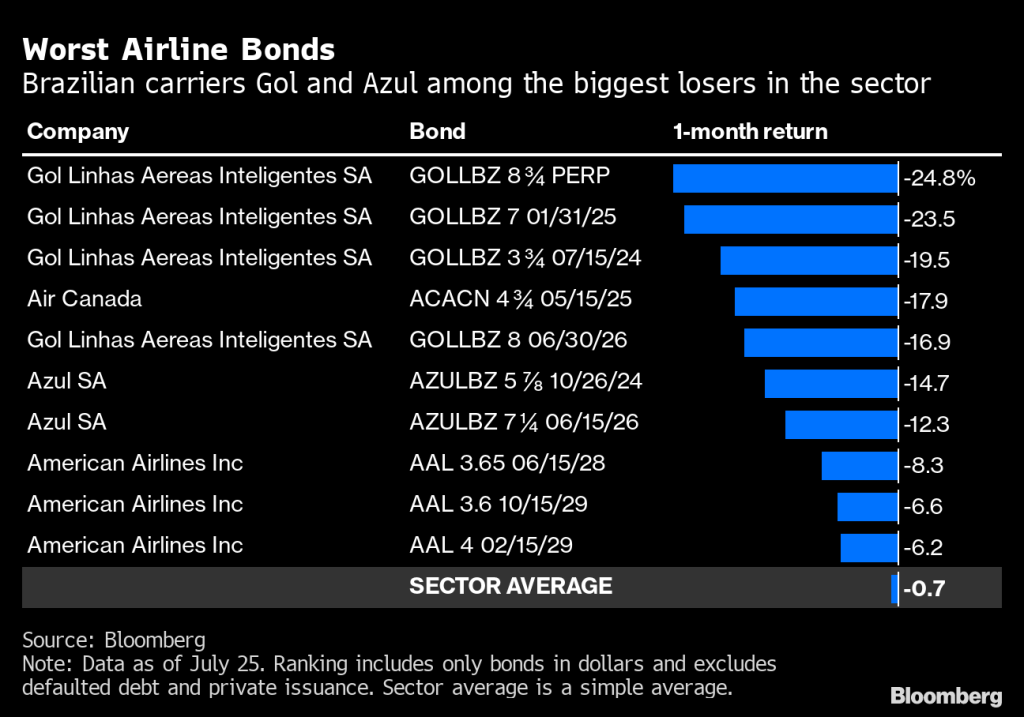

Image Source: bwbx.io

3. When are Airline Bond Ratings Determined?

4. Where Can Airline Bond Ratings be Found?

5. Why are Airline Bond Ratings Important?

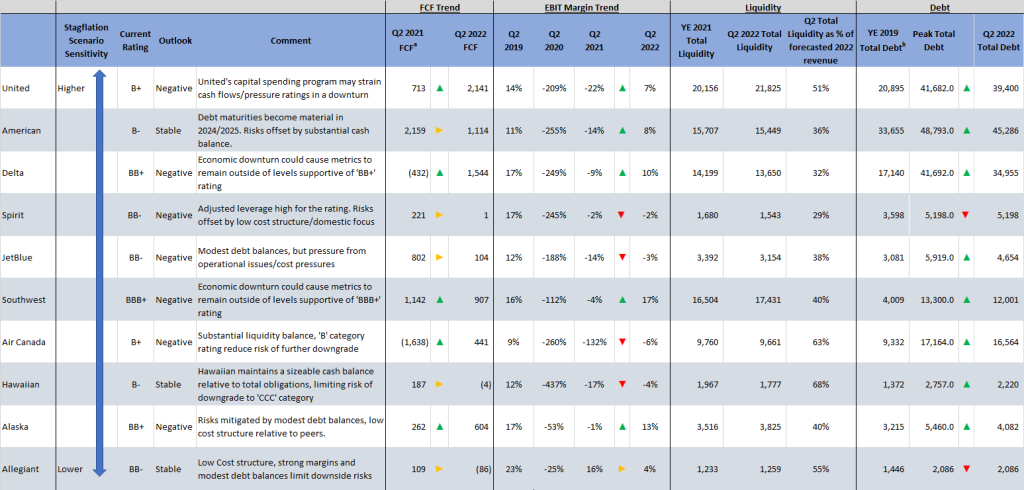

Image Source: jifo.co

6. How are Airline Bond Ratings Calculated?

7. The Role of Airline Bond Ratings in the Aviation Industry

What are Airline Bond Ratings?

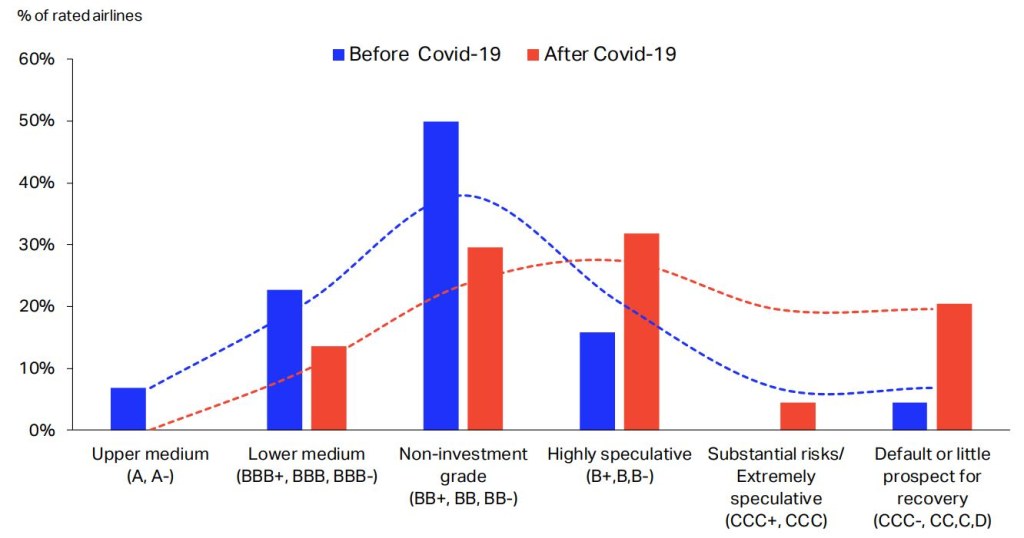

Image Source: centreforaviation.com

Airline bond ratings are assessments of the creditworthiness of airlines. These ratings are assigned by credit rating agencies, such as Standard & Poor’s, Moody’s, and Fitch Ratings. They evaluate the financial health, debt repayment capacity, and overall risk associated with an airline’s bonds.

With emoji: Airline bond ratings provide crucial insights into the financial health and creditworthiness of airlines. 📊✈️

Who Assigns Airline Bond Ratings?

Credit rating agencies are responsible for assigning airline bond ratings. These agencies have a team of analysts who conduct comprehensive evaluations of an airline’s financial statements, industry trends, and macroeconomic factors. Based on their analysis, they assign a rating to the airline’s bonds, indicating the level of risk associated with the investment.

With emoji: Credit rating agencies, consisting of experienced analysts, assign airline bond ratings based on thorough evaluations. 🔍📈

When are Airline Bond Ratings Determined?

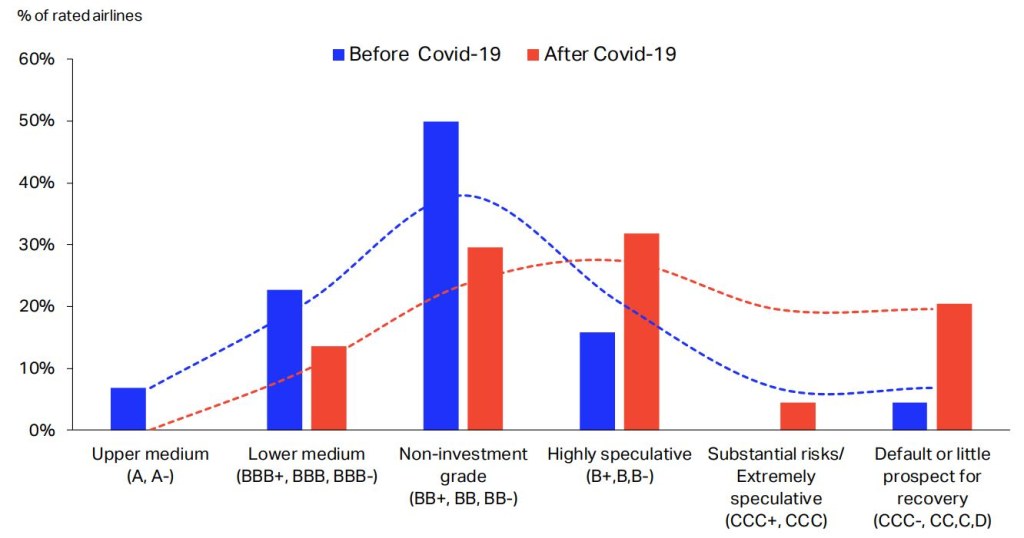

Airline bond ratings are determined at various stages of an airline’s operations. They are initially assigned when an airline issues bonds in the market. Subsequently, credit rating agencies review and update these ratings periodically, considering factors such as the airline’s financial performance, debt levels, and market conditions.

With emoji: Airline bond ratings are determined during bond issuances and are reviewed periodically to reflect changes in the airline’s financial performance. 🛫📆

Where Can Airline Bond Ratings be Found?

Airline bond ratings can be found on the websites of credit rating agencies. These agencies provide detailed reports and analysis, allowing investors and stakeholders to assess an airline’s creditworthiness. Additionally, financial news platforms and investment research websites also publish summaries of airline bond ratings, making them accessible to a wider audience.

With emoji: Airline bond ratings can be easily accessed on credit rating agency websites and financial news platforms. 💻📰

Why are Airline Bond Ratings Important?

Airline bond ratings are important for several reasons. Firstly, they provide valuable information to investors and bondholders, helping them assess the risk associated with investing in an airline’s bonds. Secondly, these ratings influence an airline’s borrowing costs and access to credit markets. Higher ratings result in lower borrowing costs, while lower ratings can make it challenging for airlines to secure financing at favorable terms.

With emoji: Airline bond ratings are crucial as they guide investors, impact borrowing costs, and determine an airline’s access to credit markets. 💰🌐

How are Airline Bond Ratings Calculated?

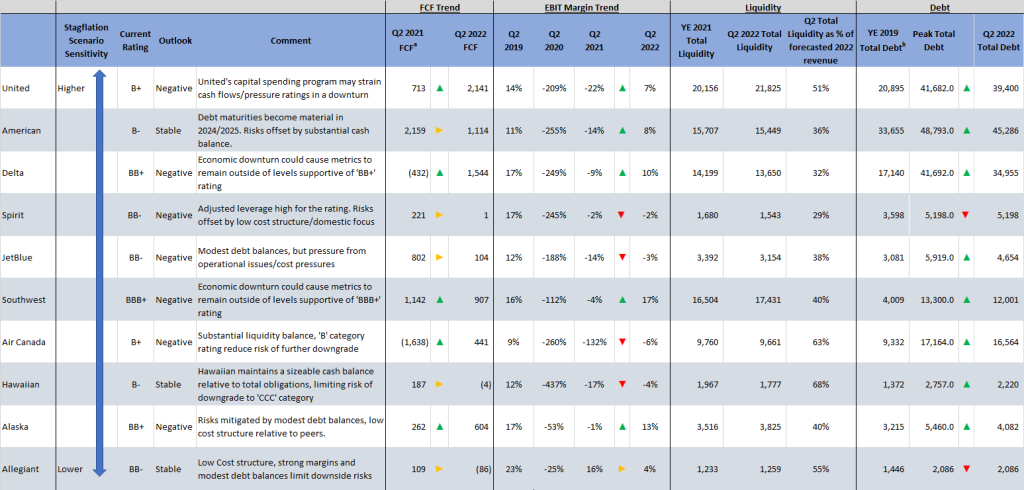

Airline bond ratings are calculated based on an in-depth analysis of various financial and non-financial factors. These factors include the airline’s financial statements, debt levels, profitability, liquidity, industry trends, and the overall economic environment. Credit rating agencies assign ratings using a standardized rating scale, such as AAA, AA, A, BBB, etc., with each rating indicating a different level of creditworthiness and risk.

With emoji: Airline bond ratings are determined through meticulous analysis of financial and non-financial factors, resulting in standardized ratings indicating creditworthiness. 📚🔢

The Role of Airline Bond Ratings in the Aviation Industry

Airline bond ratings play a significant role in the aviation industry. They impact an airline’s ability to raise capital, expand operations, and negotiate favorable terms with suppliers and lenders. Additionally, these ratings influence investor sentiment, affecting the airline’s stock performance and overall market perception. Therefore, maintaining favorable bond ratings is crucial for airlines to thrive in a highly competitive and capital-intensive industry.

With emoji: Airline bond ratings shape the aviation industry, influencing financing decisions, investor sentiment, and market perception. ✈️💼

Advantages and Disadvantages of Airline Bond Ratings

1. Advantages:

– Enhanced transparency and information for investors

– Facilitation of efficient capital allocation

– Improved access to credit markets

– Differentiation between creditworthy and risky airlines

– Mitigation of investment risks

– Promotion of financial discipline among airlines

2. Disadvantages:

– Potential limitations in capturing industry-specific risks

– Subjectivity and potential conflicts of interest in ratings

– Limited coverage of smaller and non-publicly traded airlines

– Possible lag in reflecting rapid changes in the airline industry

– Market reliance on ratings, leading to herding behavior and excessive market volatility

Frequently Asked Questions (FAQs)

1. What factors do credit rating agencies consider when assigning airline bond ratings?

Answer: Credit rating agencies consider a range of factors, including an airline’s financial performance, debt levels, profitability, liquidity, industry trends, and macroeconomic conditions.

2. How often are airline bond ratings updated?

Answer: Airline bond ratings are periodically reviewed and updated by credit rating agencies to reflect changes in an airline’s financial health and market conditions.

3. Can airline bond ratings change over time?

Answer: Yes, airline bond ratings can change based on an airline’s financial performance, industry dynamics, and other relevant factors. Upgrades or downgrades in ratings are common.

4. Are airline bond ratings only relevant to investors?

Answer: No, airline bond ratings have broader implications. They impact an airline’s borrowing costs, access to credit markets, and overall market perception, influencing stakeholders such as suppliers, lenders, and customers.

5. How do airlines with lower ratings attract financing?

Answer: Airlines with lower ratings may have to offer higher interest rates or collateralize their debt to attract financing. They can also work towards improving their financial position to secure better ratings in the future.

Conclusion

In conclusion, airline bond ratings serve as vital tools for assessing the financial stability and creditworthiness of airlines. These ratings enable investors and stakeholders to make informed decisions, guide borrowing costs, and influence an airline’s access to credit markets. While they provide valuable insights, it is important to acknowledge the advantages and disadvantages associated with airline bond ratings. By understanding the intricacies of these ratings, individuals and organizations can navigate the aviation industry with greater confidence and prudence.

Final Remarks

Disclaimer: The information presented in this article is for educational and informational purposes only. It should not be considered as financial advice or a recommendation for investing in airline bonds. Readers are encouraged to conduct their own research and consult with financial professionals before making any investment decisions. The author and the website disclaim any liability for financial losses or decisions made based on the information provided.

This post topic: Air Travel Tips